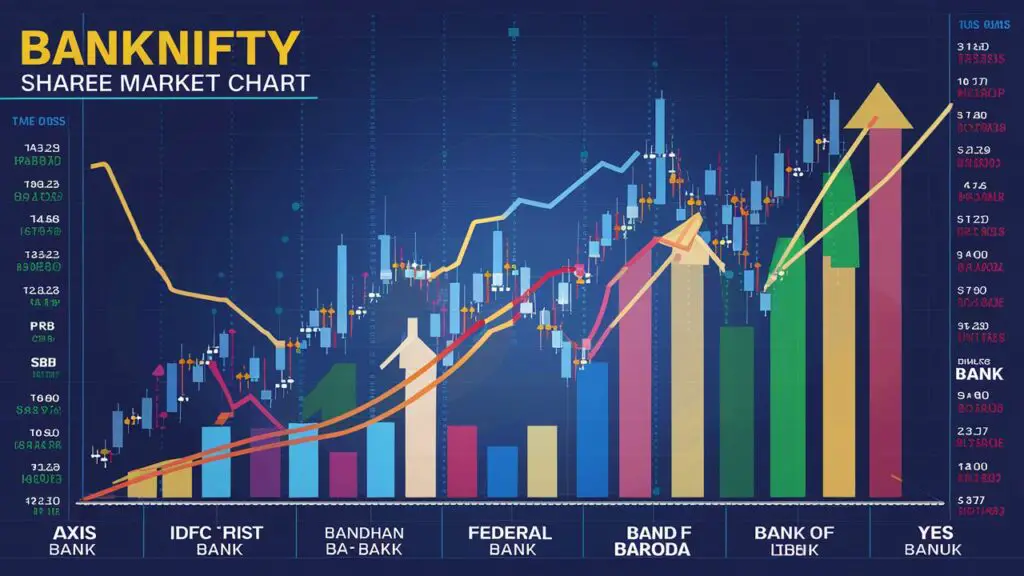

Bank Nifty is a free float market cap weighted index that focuses exclusively on banking stocks. Bank Nifty is already one of the actively traded index futures and options in the F&O market. It is considered important due to its high weightage in Nifty and its high correlation with Nifty. Below is the chart of Bank Nifty since its inception.

What does Bank Nifty indicate?

Bank Nifty is a sectoral index focusing only on banking stocks and includes private and PSU banks. It is one of the most actively traded indicators in the futures and options segment and is available for F&O trading on NSE. Bank Nifty is calculated using free float method where stocks are weighted based on free float market capitalization. While Bank Nifty was launched on September 15, 2003, it uses January 01, 2000 with a base value of 1000. It means that at current Bank Nifty value of ~30,000, it represents 30 times wealth creation in last 19 years. The index is rebalanced semi-annually and Bank Nifty values are available on real time during trading hours. It is the first index available for weekly options and currently has more trading volume than Nifty.

Stock-mix of Bank Nifty Index

Being a sectoral index, Bank Nifty represents only the banking sector; Which includes private banks and PSU banks. The Bank Nifty represents the 12 most liquid and largest capitalized stocks in the banking sector traded on the NSE. It provides investors and market intermediaries with a benchmark that showcases the capital markets of the Indian banking sector.